President Trump’s plans to give a massive tax break to the rich but a polling shows that an overwhelming majority of Americans favor raising taxes on the wealthy. The disconnect could complicate Republican efforts to pass tax legislation this year.

“As progressives strategize for the tax fight coming this fall, they open the debate with a clear advantage: public opinion is on their side,” researchers from the Mellman Group, the Global Strategy Group, Hart Research Associates, and the progressive Not One Penny Campaign noted in a release last week. “Not only do a majority of Americans believe the wealthy and corporations pay less than their fair share in taxes, but they think that their taxes should be raised – not lowered. This view is in direct contradiction to the tax plan being assembled by Republicans in Washington.”

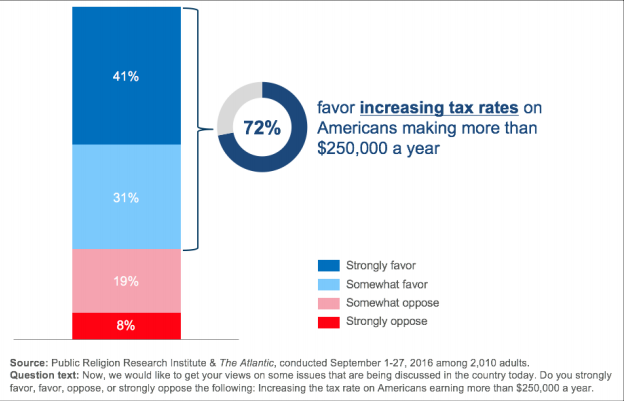

The poll in question, conducted by the Public Religion Research Institute and The Atlantic in September, showed that 72 percent of registered voters favored “increasing taxes on Americans earning more than $250,000 a year”; 41 percent “strongly favor[ed]” raising taxes for the wealthy. Only 27 percent of registered voters were opposed. Nine percent of those polled said they were “in strong opposition.”

A Mellman Group survey last October reflected similar findings: among registered voters, 69 percent—including “42 percent of Republicans”— supported raising taxes for the wealthy. A poll conducted by the Global Strategy Group in April showed even higher numbers, with 88 percent of registered voters saying that “making sure the wealthiest Americans pay their fair share in taxes will help grow the economy.”

Trump’s tax plan, which he outlined earlier this year, would cut the corporate tax rate to 15 percent and would lower taxes for high-income earners from 39.6 percent to 35 percent. According to The New York Times, Trump’s plan would also “eliminate a 3.8 percent tax, used to help fund Obamacare, that applies to investment income over $250,000 for a couple.” It would also eliminate the estate tax—which applies to those with estates valued at $5.5 million or more—allowing millionaires to pass their fortunes onto their heirs tax-free. Upper-middle class earners would lose the federal tax deduction, significantly impacting those in high-tax states.

“We have a once-in-a-generation opportunity to do something really big,” Trump’s Chief Economic Adviser Gary Cohn said at the time. In an interview with Fox News’ Tucker Carlson later, Treasury Secretary Steve Mnuchin added, “Effectively, the effective tax rate will not be a reduction for the rich. …This is really about a middle-income tax cut.”

According to the nonpartisan Tax Policy Center, however, the president’s proposal would save the top 1 percent of earners around 14.1 percent a year (approximately $317,000); the top one-tenth of 1 percent would receive a cut of around $638,000. Middle-income households, by contrast, would save only 1.5 percent—around $1,100. According to CNBC, “fewer than 5 percent of households in the middle quintile of the income distribution would see a reduction, averaging about $370.”

“Regardless of what state you live in, the Trump tax proposals were not created to benefit you unless you are really well-off,” Steve Wamhoff, senior fellow for federal tax policy at the left-leaning Institute on Taxation and Economic Policy, wrote in July. “In fact, low- and middle-income people would inevitably face a net loss after cuts to health care, education, nutrition and other public investments that would inevitably follow.”

The more that voters learn about the impact of Trump’s proposals on the large corporations and the wealthy, the less they like it. “As voters become more aware of the degree to which the wealthiest Americans and large corporations will benefit from tax cuts, they become intensely unfavorable to the plans of President Trump and the Republican Congress,” the researchers stated.