In 2016, after the signing of the Paris climate agreement, there was a sharp decrease in bank financing for “extreme fossil fuels.” However, 2017 was a year of “backsliding” into financing the fossil fuel sector again, according to a new report.

The world’s largest banks provided $115 billion in funding to the fossil fuel industry in 2017, up 11 percent from the year before. The increase was driven largely by a boost in financing of the tar sands sector in Alberta, Canada.

If financing of the tar sands sector had remained stable in 2017, relative to the previous year, overall funding of extreme fossil fuels by large banks would have dropped by about $10 billion. Extreme fossil fuels refer to extreme oil (tar sands, Arctic, and ultra-deepwater oil), liquefied natural gas exports, coal mining, and coal-fired generation.

On a regional basis, while some European banks have calculated the risks and put policy restrictions on some of their fossil fuel financing, major players elsewhere have done little to adopt policies that would bring their activities in line with the Paris climate agreement, according to the report.

Released Wednesday, the study, “Banking on Climate Change 2018: Fossil Fuel Finance Report Card 2018,” is the ninth annual report ranking bank policies and practices related to the financing of some of the most carbon-intensive, financially risky, and environmentally destructive fossil fuel sectors. The report was sponsored by Rainforest Action Network, BankTrack, Indigenous Environmental Network, Oil Change International, Sierra Club, and Honor The Earth.

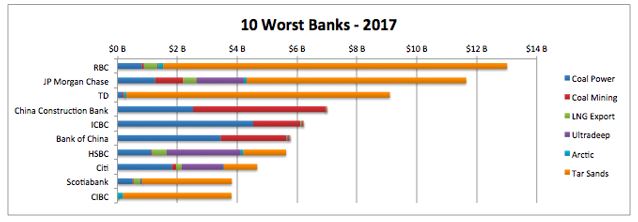

The researchers assessed 36 private banks from Australia, Canada, China, Europe, Japan, and the United States. Royal Bank of Canada, Toronto Dominion Bank, and JPMorgan Chase all surpassed Chinese banks to become the biggest bankers of fossil fuel projects. JPMorgan Chase, for example, increased funding to coal mining by 21 times and quadrupled its financing of tar sands oil.

“Tar sands and other fossil fuel projects threaten our climate, public health, and communities,” Kelly Martin, director of the Sierra Club’s Beyond Dirty Fuels campaign, said Wednesday, in a statement. “There is a growing international movement calling on our financial institutions to do better, and we will not stop until they pull their support of dirty fossil fuels once and for all.”

According to the report, banks did not suddenly decide in 2017 that tar sands oil is a great long-term prospect. Rather, the increase in funding was in large part to finance the purchase by Canadian companies of the tar sands reserves sold off by oil majors who deemed the polluting fossil fuel too expensive to continue extracting. Companies like Shell, ConocoPhillips, and Statoil sold more than $23 billion in Canadian assets in 2017 in order to focus on lower-cost reserves elsewhere.

The increase in banks’ support for tar sands in 2017 — to nearly $47 billion — led this sector to overtake investment in coal power, the best funded of the extreme fossil sectors in 2016, according to the report.

“Every single dollar that these banks provide for the expansion of the fossil fuel industry is a dollar going to increase the climate crisis,” Stephen Kretzmann, executive director of Oil Change International, an independent anti-fossil fuel research group, said in a statement.

The surge in bank financing for fossil fuel projects, primarily for the acquisition of assets in the Canadian tar sands, coincided with President Trump pushing what he called a “new era of American energy dominance.” Last summer, Trump announced that the Department of Treasury would remove barriers to U.S. government financing of new coal plants overseas. Led by the Obama administration, the Organisation for Economic Co-operation and Development reached an agreement in 2015 that removed financial support for large coal-fired power plants, while allowing support for smaller coal plants in developing countries.

For the new report, researchers calculated how much banks have financed the top 30 companies in each of these subsectors — in addition to six tar sands pipeline companies — over the past three years. Lending and underwriting amounts are weighted based on the fossil fuel company’s activities in a given subsector.

Aside from the surge in tar sands funding and a small increase in coal mining financing, investments in all other forms of extreme fossil fuels dropped in 2017.

In 2017, coal mining financing, outside of China, more than doubled over the past year. Despite the dramatic increase outside of China, financing of the global coal mining sector increased by only 5 percent. The small boost came after a sharp 38 percent drop in coal mining financing between 2015 and 2016, a decrease that occurred after the signing of the Paris agreement in late 2015.

Financing for ultra-deepwater oil projects around the world totaled $52 billion in 2017, led by JPMorgan Chase, HSBC, and Bank of America. Banks also financed $45 billion for liquefied natural gas activities of companies involved with export terminals in North America, though the financing is on a downward trend, according to the report. Morgan Stanley, Société Générale, and MUFG were the top bankers in the LNG sector.

The report pointed out that JPMorgan Chase, as the number one U.S. banker of extreme fossil fuels, continues to be uniquely exposed, among its peers, to climate risk. In particular, JPMorgan Chase’s financing for tar sands and coal mining “have gone through the roof,” the report said.

JPMorgan Chase is also the top banker of ultra-deepwater oil, and was the top Western banker of coal power over the past three years.

“At a time when some European banks like BNP Paribas and ING are adopting policies that sharply restrict their lending to some of the worst fossil fuels, U.S. and Canadian banks like JPMorgan Chase and TD are moving backwards in lockstep with their wrongheaded political leaders,” Alison Kirsch, climate and energy research coordinator at Rainforest Action Network, said in a statement. “Banks need to be accountable and implement policies guarding against extreme fossil fuel funding.”