Polluting robots of the world, unite! The GOP tax bill is for you.

The rest of us, however, have a lot to lose from GOP tax changes that favor investments in dirty energy over clean — and robots over human workers.

As one MIT economist told Newsweek, “We are creating huge subsidies in our tax code for capital and encouraging employers to use machines instead of labor.” And unless significant changes are made in the GOP plan, those machines will be running on dirty energy.

Last month, I discussed how the House tax bill targets key solar and wind energy tax credits that have helped make clean energy a crucial high-wage job-creating sector in the United States.

The good news is that the Senate tax bill doesn’t roll back those renewable energy tax credits. The bad news is that it contains language that could seriously undermine the investment in renewables by imposing “a new 100 percent tax” on those credits, as Gregory Wetstone, head of the American Council on Renewable Energy, explained in a statement.

“If this bill passes as drafted, major financial institutions would no longer participate in tax equity financing, which is the principal mechanism for monetizing credits,” Wetstone pointed out. “Almost overnight, you would see a devastating reduction in wind and solar energy investment and development.” Meanwhile, tax subsidies for fossil fuels, many of which are decades old, would continue unchanged–and the Senate bill opens up the Arctic National Wildlife Refuge to drilling.

This type of clean energy financing will reach $12 billion this year, according to Bloomberg New Energy Finance, which examined the impact of this change in detail.

This investment, much of it by multinational finance companies, has helped leveraged some $50 billion a year in U.S. wind and solar projects, creating hundreds of thousands of jobs.

Ironically — or, rather, tragically — harming renewables mostly harms red states. As “The American Prospect” noted, “The states that voted for Trump produce nearly 70 percent of wind energy, while 85 percent of existing wind projects are in GOP-held congressional districts.”

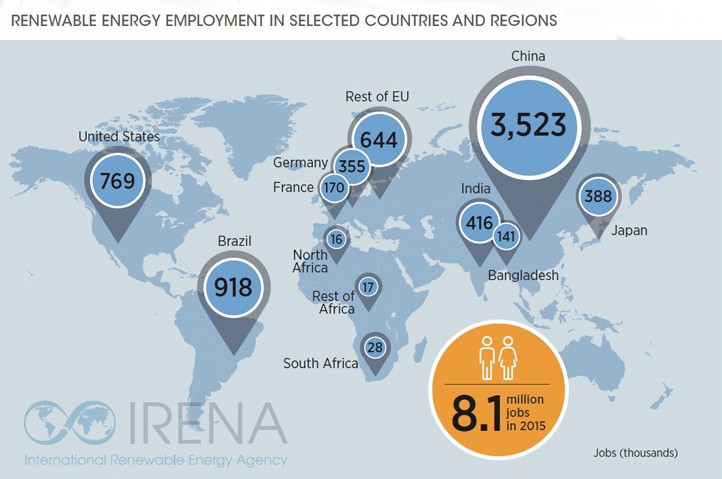

As for longer-term impacts, the GOP plan would cut billions of dollars in incentives for the biggest new source of sustainable high-wage employment in the world — clean energy — just as China and the rest of the world are making massive investments.

What’s unknown at this point is how these and other changes to these tax credits will be dealt with in the final bill, after the House and Senate work out their differences. While the House plan to gut the credits was intentional, it’s not clear that Senators intended to undermine them, so the problem is fixable.

One thing that was very intentional was the “full and immediate expensing of equipment purchases” provision. This would let companies deduct from their taxes the full cost of some types of investments, such as new industrial equipment, that are currently only allowed a 50 percent deduction.

This change would occur just when companies are beginning to automate their factories using robots and advanced computing technology, as corporate tax attorney Robert Kovacev, explained to Huffington Post: “It’s going to accelerate spending, basically, on robots that could displace workers.”

PricewaterhouseCoopers had already projected that over the next 15 years over a third of U.S. jobs could be lost to automation.

The GOP plan naturally has no tax incentives to encourage businesses to hire more actual workers or to retrain those who lose their job due to automation

Indeed, the Senate bill is so bad that Bloomberg’s editors wrote a piece explaining “Republicans have managed to make a terrible plan worse.” As one example the equipment-expensing provision would take effect immediately, but the Senate only lowers the corporate tax rate to 20 percent (from 35) in 2019.

“This will allow businesses to take deductions on investments while rates are high, then pay a lower rate on the resulting income, creating a perverse incentive to pursue otherwise unprofitable projects,” explains Bloomberg. So the Senate bill actually encourages companies to replace workers even with unprofitable robots.

Unprofitable polluting robots — quite a legacy for the disastrous GOP tax plan.