The federal Department of Housing and Urban Development (HUD) on Monday notified a group that brought a complaint against Treasury Secretary Steve Mnuchin’s former bank that it will investigate its allegations of redlining.

Mnuchin served as CEO of mortgage lender OneWest between buying it in 2009 and selling it in 2015. According to the complaint filed by the California Reinvestment Coalition, since at least 2011, OneWest — now known as CIT Bank, after it was acquired in 2015— violated the Fair Housing Act by giving fewer mortgages to people of color, locating few branches in communities of color, and maintaining foreclosed properties in white neighborhoods better than black or Latino ones.

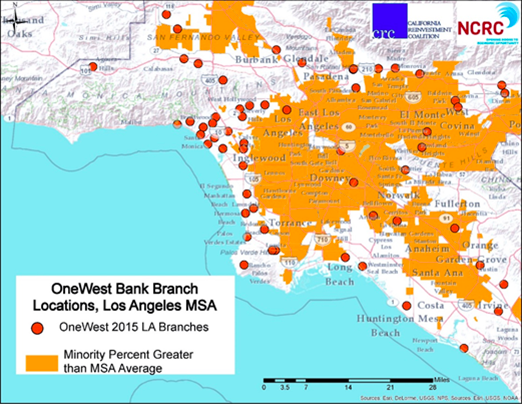

The complaint alleges that in the California neighborhoods it examined, none of OneWest’s home loans went to black borrowers, .01 percent went to Latino borrowers, and .02 percent went to Asian ones. It also claims that there were zero OneWest branches in predominantly black Los Angeles neighborhoods, just one in Asian neighborhoods, and 11 in Latino ones.

“OneWest’s pattern of locating branches mostly in predominantly white communities raised red flags because it translates to less access to branches, less access to bank accounts, and less access to credit — including mortgages — in communities of color,” Paulina Gonzalez, executive director at the California Reinvestment Coalition, said in a statement.

“We will be watching closely to see what HUD finds with its more in-depth investigation,” Gonzalez added. HUD declined to comment on the matter other than confirming that it received the group’s initial complaint.

The bank is also under fire for other reasons. HUD’s Office of Inspector General is currently investigating its reverse mortgage unit, which made up nearly 40 percent of foreclosures on these types of loans that are typically taken out by older homeowners, despite serving 17 percent of the market. New York’s Attorney General Eric Schneiderman is also investigating that unit.

Mnuchin was confirmed by the Senate on Monday night to serve as Treasury Secretary. He will now play a key part in financial regulation, particularly in President Trump’s efforts to undo the Dodd-Frank banking reforms put in place after the mortgage crisis and recession. Those reforms are meant to rein in risky and illegal Wall Street behavior.