Something strange and unfamiliar has taken root in Washington, DC these past few days. In between segments about Donald Trump’s latest impeachable offense, Republican intransigence in the face of a cataclysmic government shutdown, and whatever other mundanity du jour is on the docket, cable news shows have carved out time to talk about honest-to-God policy proposals.

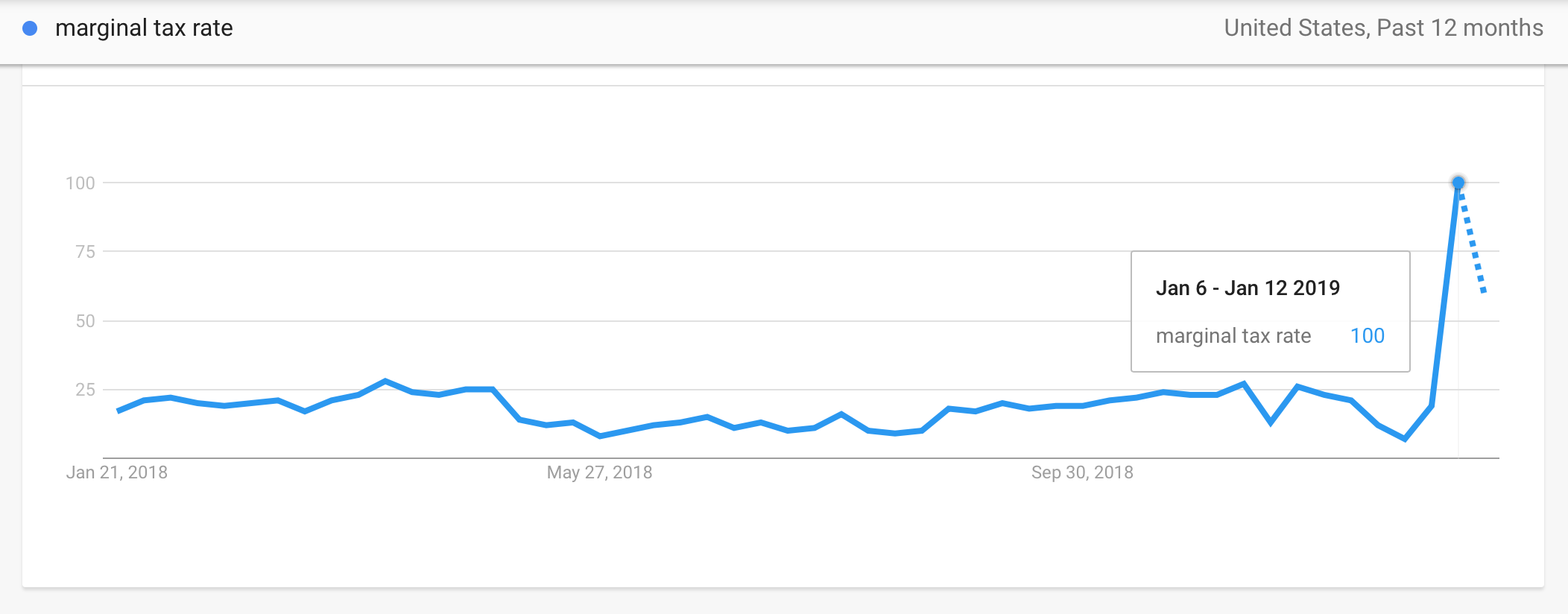

Specifically, we find ourselves amidst a nationwide conversation about, of all things, marginal tax rates. How we got here is clear: a rising star of the Democratic Party has sought to introduce herself to the American people by extolling the virtues of making the wealthiest among them pay their fair share for the good of the country.

“Look, there was a time in a very prosperous America — an America that was growing a middle class, an America in which working families were doing better generation after generation after generation — where the top marginal rate was well above 50 percent,” she said, in defense of her call for a thorough re-examination of the federal tax code, which has sustained multiple rounds of Republican sabotage over the past few decades.

And yes, Rep. Alexandria Ocasio-Cortez (D-NY) has also been talking about marginal tax rates. But the aforementioned quote is not from Congress’ youngest representative. Rather, it comes courtesy of newly minted presidential candidate Sen. Elizabeth Warren (D-MA). The comment came this past July, during an interview with an incredulous CNBC host.

Warren’s entire political career has been largely built upon a platform of meticulously crafted fiscal policy, in particular her fixation on ways that lawmakers might ameliorate growing income inequality and its effects.

And yet, Warren’s decades of experience in the fields of consumer finance and law has lately failed to generate a fraction of the buzz that a single sentence from Ocasio-Cortez’s 15-minute segment on a recent 60 Minutes.

But this isn’t a reflection on Warren or Ocasio-Cortez. Economists of all stripes are capable of thoughtful, reasoned disagreements on the benefits and shortcomings of a 70 percent marginal tax rate, but what’s undeniable is that it is a perfectly sound fiscal policy with plenty of historical precedent, not a scary communist plot to expropriate entire incomes and hand them over to the state.

No, the wide gap in how the public reacted to Elizabeth Warren’s comments six months ago compared to Ocasio-Cortez’s comments six days ago is all down to the fact that the latter has gained an unwitting ally and a powerful secret weapon: the Republican Party.

The 60 Minutes interview hadn’t even fully aired before conservatives began hollering about Ocasio-Cortez’s proposal for a new tax bracket, which would levy a 70 percent marginal tax rate on earners who made more than $10 million a year. The more troglodytic among them fixated on Ocasio-Cortez’s age (and, of course, gender) in order to portray her as a naive, uninformed starlet mindlessly spouting socialist talking points. Those who managed to keep their sexism in check simply suggested her proposal was radical or extreme. But the whole lot of them couldn’t help but take shots at the rookie lawmaker.

In so doing, they only amplified her message. By Monday morning, her comment was everywhere. On Tuesday, reactions to her comment — from economists, politicians, historians, pollsters — proliferated all over the web. But if Republicans were hoping their signal boost would expose Ocasio Cortez, somehow discrediting her in the unforgiving gaze of public scrutiny, they miscalculated once again.

A poll commissioned by The Hill/HarrisX shortly after Ocasio Cortez’s comment aired found that a solid majority of voters — 59 percent — agreed with her proposal. Southern voters were in favor of her plan by a 14-point margin; rural voters approved by 12 points. Even self-identified Republicans were relatively warm to the plan, with 45 percent of respondents agreeing with Ocasio-Cortez’s tax proposal. Conservative commentators and lawmakers, convinced that the public would join them in excoriating Ocasio Cortez, instead drove support in her direction — moving the needle in the direction of higher taxes for the wealthiest Americans in a way few liberals have been able to accomplish.

All your base (are) belong to us 👾 https://t.co/brwNKJ8wrh

— Alexandria Ocasio-Cortez (@AOC) January 19, 2019

This is not to discount the efforts of Ocasio-Cortez herself. From the moment she burst onto the scene after unseating the fourth most powerful Democrat in the House during last June’s primary, AOC has played her conservative haters like a fiddle. Each time Fox News tries to paint her as a radical, she calmly fires up Instagram and conducts an impromptu town hall from her kitchen on the moral imperative of universal health care or affordable higher education. Every time a Republican lawmaker tries to embarrass her on Twitter for misspeaking, she takes to the same platform to dunk on them with such ease and ruthlessness it’s a miracle they don’t delete their accounts on the spot.

The truth is, Republicans would have been far better off had they simply ignored Ocasio-Cortez altogether. You didn’t hear as much about Elizabeth Warren’s similar comments on marginal tax rates this past summer because the conservative media apparatus largely slept through them. Now, the entire Democratic primary field in 2020 are going to be asked about raising the tax rates on the incomes of top earners. As this week’s polling shows, that conversation will largely be to their benefit.