It may seem intuitive that states that invest more in public services are better places for children to grow up, but the Foundation for Child Development now has the numbers to prove it. The foundation is out with a new study that confirms the “strong relationship” between higher state taxes and children’s health.

The study used a comprehensive Child Well-Being Index (CWI) to assess children’s quality-of-life in each state. Some of the key findings include:

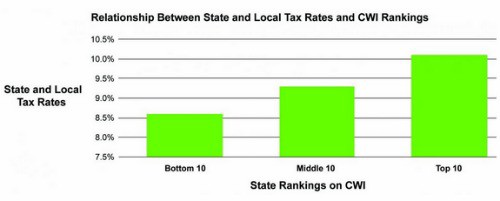

Higher State Taxes Are Better for Children: States that have higher tax rates generate higher revenues and have higher CWI values than states with lower tax rates.

Public Investments in Children Matter: The amount of public investments in programs is strongly related to CWI values among states. Specifically, higher per-pupil spending on education, higher Medicaid child-eligibility thresholds, and higher levels of Temporary Assistance for Needy Families (TANF) benefits show a substantial correlation with child well-being across states.

A Child’s Well-Being Is Strongly Related to the State Where He or She Lives: Child well-being varies tremendously from state to state, ranging from a 0.85 index value for New Jersey, the highest ranked state, to a negative 0.96 index value for New Mexico, the lowest-ranked state.

Ruby Takanishi, the president of the organization, explains that state spending has a particularly large impact on children “because less than 10 percent of the federal budget is invested in children’s programs.” “With this new measure, we can see proof of the direct impact of state policies: when states invest in children, children do better,” she said.