“More than 37 million plug-in electric vehicles are expected to be in use in 2025,” Navigant Research reported this week. By then, we can expect EVs “to be cost competitive against conventional vehicles without subsides,” making it likely that light-duty vehicles “will eventually be electric rather than any other alternative.”

The key questions as we look ahead to the future of EVs are: Will President-elect Donald Trump — whose cabinet is so pro-oil that the Secretary of State nominee is the former CEO of ExxonMobil — continue pro-EV policies that would prove fatal to the oil industry? Or will China and Europe become the leaders in one of the fastest-growing job-creating industries?

Modern EVs have key advantages over traditional vehicles, like faster acceleration, lower maintenance costs, and no tail-pipe emissions. And they are the only alternative fuel car with a much lower per-mile fueling cost than petrol cars — even when running on carbon-free fuel. The sticking points have been the high initial cost and the short range, due to expensive and bulky batteries.

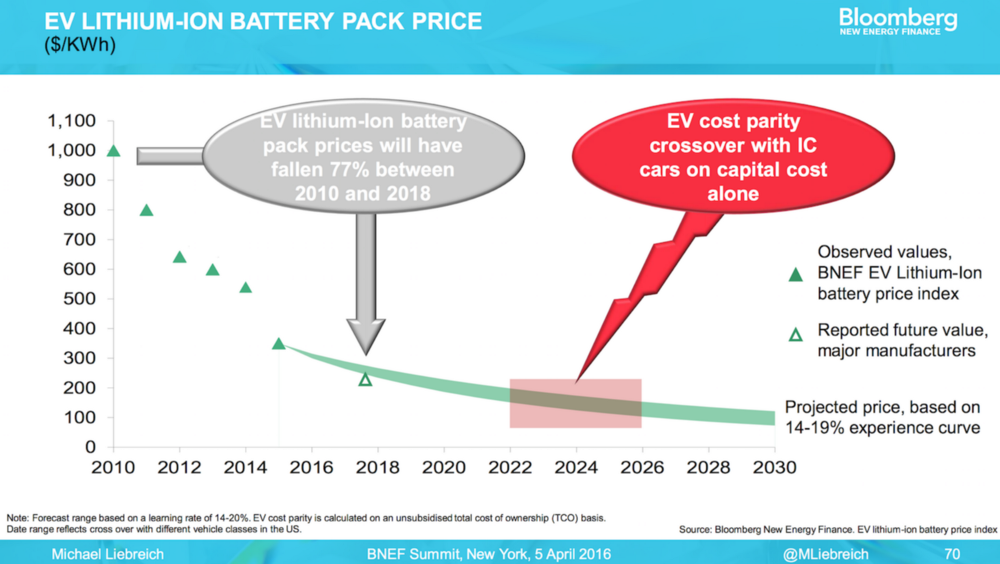

Now, driven by smart government policies — including a big bet by President Obama’s Department of Energy (DOE) on a once-obscure Silicon Valley start up named Tesla — rapid drops in battery cost have brought us to the start of the revolution, as this Bloomberg New Energy Finance BNEF chart shows:

The result, as the lead author of a GTM Research report on EVs explained, is that “a price and energy cost analysis of conventional, hybrid, and electric vehicles illustrates that the EV has the lowest lifetime cost, even in a low-oil-price environment.”

Both BNEF and the International Energy Agency (IEA) now expect we will see EV sticker prices directly competitive with that of gas-powered cars within a decade. Yet the EVs will offer superior performance and zero total emissions (running on renewables), and will be far cheaper to operate, especially as solar and wind power prices drop.

No wonder every country is racing to be the EV leader. Last fall, the Guardian reported, “every new or refurbished house in Europe will need to be equipped with an electric vehicle recharging point, under a draft E.U. directive expected to come into effect by 2019.”

The Norwegians and Dutch are already pursuing a ban on gasoline- and diesel-fueled cars for 2025. German legislators have voted for a resolution to ban the internal combustion engine by 2030. India has also announced it plans to be a “100 percent electric vehicle nation” by 2030.

And China is placing the biggest bet on batteries and EVs, leading to explosive growth:

China is already the world’s largest EV market. Beijing is aiming for a 10-fold increase in sales by 2025, offering subsidies up to 60 percent of an EV’s cost. Just as it did in the solar market, China plans to become the world EV leader with massive investments that drive big price drops and exponential growth.

The good news is that the U.S. is currently a market leader with companies like Tesla and GM introducing 200-plus-mile range vehicles for under $40,000. Ford Motors is also betting big on EVs.

But U.S. leadership was driven in large part by government support for the industry, including a major loan from DOE to Tesla, as well national incentives and fuel economy standards, together with state-based incentives and policies to promote zero-emission vehicles. That’s bad news because team Trump appears to oppose most, if not all, of those kind of policies.

It’s especially bad news that Trump is stacking his cabinet and administration with executives, lobbyists, and shills for Big Oil. After all, advanced batteries could “tip the oil market from growth to contraction earlier than anticipated,” as the credit rating agency Fitch concluded last fall. BNEF has already told investors to expect the ‘big crash’ in oil by 2028 — and as early as 2023.

We’re in a global race to be the leader in a transportation revolution that will generate millions of jobs while transforming multiple industries. Europe, India, and China are putting their feet on the accelerator. Will President Trump hit the brakes?