Both the Arctic and Antarctic keep smashing records for ice loss, providing more evidence we are headed for the worst-case scenario of sea level rise. At the same time, President Trump plans to block climate action while slashing funding for coastal adaptation and monitoring.

Together, this is very bad news for U.S. coastlines, and the only question left for Americans is: When will coastal property values crash?

As I’ve written for years, values will will start dropping before we hit a few feet of sea level rise. They will crash when a large fraction of the financial community — mortgage bankers and opinion-makers, along with a smaller but substantial fraction of the public — realize that it is too late for us to stop catastrophic sea level rise.

Sean Becketti, the chief economist for mortgage giant Freddie Mac, warned nearly a year ago this scenario is coming faster than expected. “Some residents will cash out early and suffer minimal losses. Others will not be so lucky,” Becketti said.

The country is facing a trillion-dollar bubble in coastal property values, a time bomb which has been inflated by U.S. taxpayers in the form of the National Flood Insurance Program. A 2014 Reuters analysis of this “slow-motion disaster” explained that there is nearly $1.25 trillion in coastal property being covered at below-market rates.

Even before Trump was elected, the process of devaluation had started. As the New York Times reported in November, “Nationally, median home prices in areas at high risk for flooding are still 4.4 percent below what they were 10 years ago, while home prices in low-risk areas are up 29.7 percent over the same period.”

When sellers outnumber buyers, and banks become reluctant to write 30-year mortgages for doomed property, and insurance rates soar, then the coastal property bubble will slow, peak, and crash. As the New York Times article points out, it has already slowed or peaked in some places.

The time for the bubble to fully burst appears to be almost at hand, thanks to accelerating sea level rise and Trump’s coastal-destroying policies. First, take a look at the science of sea level rise.

Arctic and Antarctic ice continue to disappear at an unexpectedly rapid rate. The National Snow and Ice Data Center reported that Arctic sea ice last month saw “the lowest February extent in the 38-year satellite record.” Meanwhile, the Pan-Arctic Ice Ocean Modeling and Assimilation System (PIOMAS) at the University of Washington’s Polar Science Center reported the lowest February ice volume by far.

While loss of Arctic sea ice (or any sea ice) does not raise sea levels, it does speed up the already rapid warming in the region because of Arctic amplification — a vicious cycle where higher temperatures melt reflective ice and snow, which is replaced by the dark land or blue sea, which both absorb more solar energy, leading to more melting.

This feedback loop is why the Arctic is warming twice as fast as the rest of the planet — and why we’ve been seeing so many monster heatwaves at the North Pole, temperatures 50°F (28°C) above normal.

That super-warming is driving super-fast Greenland ice loss, as well. “Things are happening a lot faster than we expected,” geophysicist Isabella Velicogna told the journal Science two weeks ago. “Nobody expected the ice sheet to lose so much mass so quickly.”

In that article, “The great Greenland meltdown,” we learned of another feedback loop that could be increasing ice melt: “Melt leads to liquid water, which fosters plant and microbial life, which darkens the ice and drives yet more melt,” scientists have found. No wonder NASA’s ice sheet measurement program has a terrifyingly relevant acronym — the Oceans Melting Greenland (OMG) project.

At the same time, Antarctica is also losing record amounts of both sea ice and landlocked ice.

A crack in Antarctica’s Larsen C ice shelf has grown sharply in recent months, putting it on a death watch. And while the collapse of floating ice shelves doesn’t add to sea level rise directly, the floating shelves act like corks that keeps inland glaciers bottled up.

As Scientific American reported last month, after the Larsen B ice shelf collapsed in 2002, satellite data revealed the velocity that glaciers connected flowed to the ocean increased “by up to a factor of eight.” Even now they are still flowing five times faster than they were.

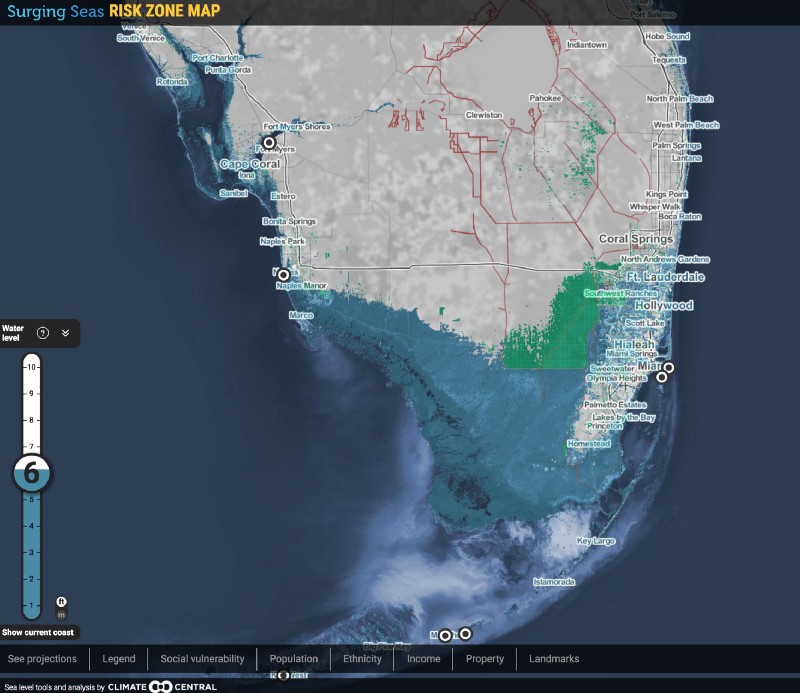

“The glaciers and ice shelves help hold back a massive ice sheet on land,” Climate Central has explained. “Their failure would send that ice to the ocean, pushing sea levels up to 13 feet higher than they are today.” Some of the latest science suggests we are close to the point of no return, beyond which ice sheet collapse becomes unstoppable.

To sum up, scientific observation and analysis now show we are headed towards the worst-case scenario of sea level rise — 4 to 6 feet or more this century alone — if we don’t reverse emissions trends sharply.

That, of course, is why 190 nations agreed in Paris in December 2015 to ratchet down carbon pollution, so total global warming would stay below catastrophic levels. And that’s why the Paris climate deal is literally humanity’s last best chance to avert multiple disasters, including devastating sea level rise.

The other reason that the coastal property bubble is about to burst is that the Trump administration is taking active measures to boost U.S. emissions and gut clean energy programs. The United States may or may not stay in the Paris Agreement, but its leaders are actively working to reduce our ability to warn coastal residents of hurricanes and storm surge in a timely fashion — and they are working to gut coastal adaptation programs.

Donald Trump has appointed climate science deniers to almost every relevant position, and he has floated budgets that would gut not just climate science, but devastate our ability to monitor ice melt and to forecast extreme coastal weather such as hurricanes.

So if you own or invest in coastal property, or insure coastal property, or write 30-year mortgages for such property, it seems pretty clear that the bursting of the coastal property bubble is closer than you might have thought.

South Miami mayor Philip Stoddard has warned that “coastal mortgages are growing into as big a bubble as the housing market of 2007.” He points out that when this bubble crashes it will never recover, but prices will continue to drop as sea levels and storm surges get higher and higher.

All signs suggest the administration is going to let the bubble burst — or even facilitate it. A leaked, draft White House budget document for NOAA zeroes out the $73-million Sea Grant program, which funds university-based research and “has been an outsized leader in coastal adaptation,” one scientist told Climate Central.

The Maryland Sea Grant Extension has been conducting “outreach and research to help coastal communities prepare for the effects of sea level rise and coastal flooding.” The Rhode Island Sea Grant program helps coastal dwellers fortify their homes against extreme weather. These kinds of programs give investors and homeowners confidence that coastal property will maintain its value. These programs appear to be ending.

So here’s the question for coastal property owners and financial institutions who are witnessing team Trump keep his coastal-destroying promises on a daily basis: Who will be the smart money that gets out early — and who will be the other kind of money?