According to new data from the Bureau of Labor Statistics, worker wages have been essentially flat since the GOP tax bill was passed in December.

The average hourly wage for production and nonsupervisory employees crept up from $9.25 in August 2018 to $9.27 in September. However, the July figure matches numbers from the same month in 2017 — effectively meaning there was no growth from the year prior. From September 2017 to September 2018, real average hourly earnings did increase 0.4 percent, per the release.

Taking a 10-year view of the data, the variation barely registers as anything more than noise on a flat line.

The report also revealed that people are working more hours on average per week, so while they are taking home more pay, it is only a marginal real impact.

This is different from the future that President Trump outlined when urging Congress to pass the tax cut bill. He said that the average family would receive a $4,000 pay raise. The entire rationale behind the tax cut was to boost Americans’ wages. But the BLS numbers prove that workers who are not bosses and who produce things are not really bringing home all that much more in pay.

Executives and corporate shareholders, however, have truly benefited from the tax cut bill. According to a chart from the Center for American Progress Action Fund, corporate profits have grown dramatically since the tax bill passed. (ThinkProgress is an editorially independent newsroom housed within the Center for American Progress.)

The last real wage numbers before November came this morning. The final verdict on the Trump economy is in: Corrupt. pic.twitter.com/79muzJD16p

— CAP Action (@CAPAction) October 11, 2018

Other private sector indices of wage growth showed a similar flatness in the third quarter. A release from PayScale Inc. showed that usually low unemployment and high corporate profits translate to higher wages, but this has not been happening:

The most recent Q3 Index showed wage growth across the U.S. was generally flat. Currently, the U.S. economy is experiencing record corporate profits, low unemployment rates and a booming stock market — economic indicators which typically drive wages upward. In addition to stagnant nominal wage growth, real wages for Q3 were down 1.8 percent from Q3 2017 which means the average person can purchase even less than they could last year when wages are measured in relation to inflation.

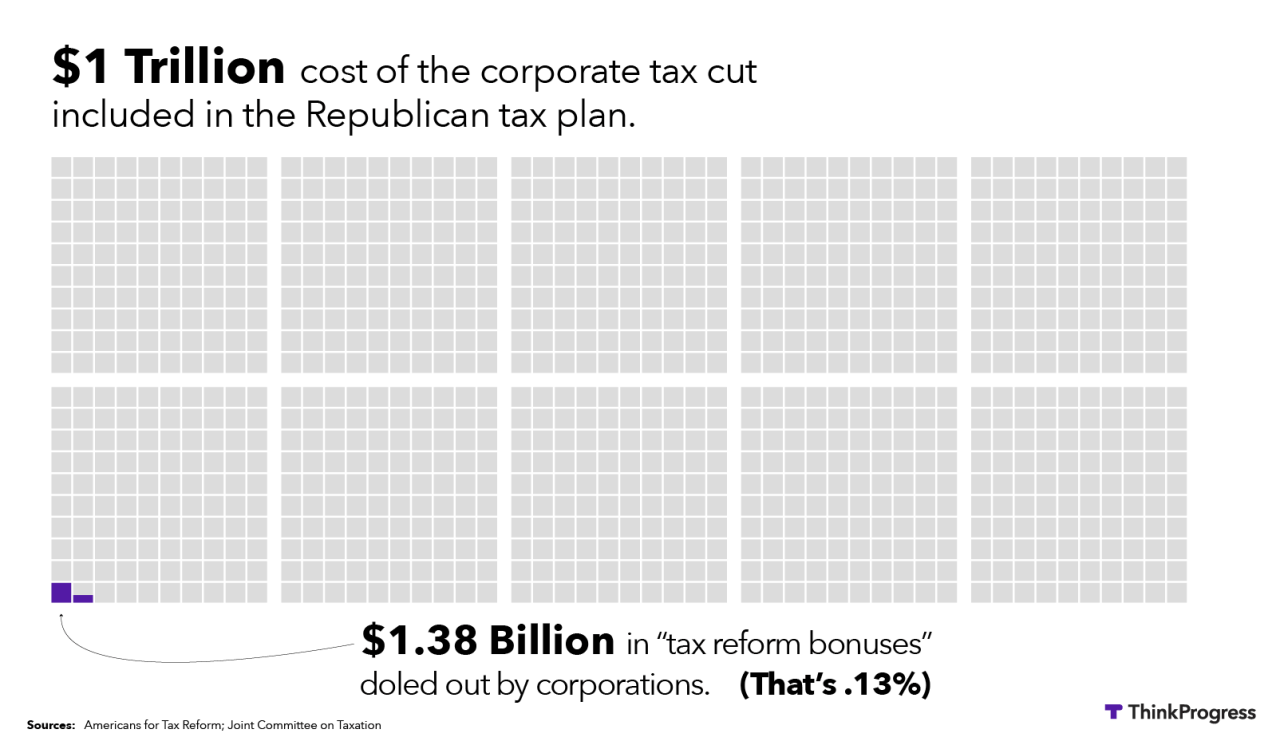

The GOP tax bill was targeted at corporations and the wealthiest Americans, something they realized early on. To help sell the bill to the American people, those running companies like AT&T, Wells Fargo, and Comcast began a public push — helped along by the White House and Republicans in Congress — to hype up the bonuses they were awarding to their workers as a demonstration of “trickle-down” economics available to them under the new legislation.

However, the total of those announced bonuses totaled roughly $981 million, while the cost of the tax bill was actually $1.4 trillion, meaning workers got only 0.9 percent, according to analysis by ThinkProgress.

Many of those business, including Walmart, touted the bonuses they were giving just as they were using their tax savings to offer stock buybacks to shareholders and to offset the cost of closing stores where thousands of people worked. And because the bonuses only happen once, workers won’t get more unless yearly wages rise — which they haven’t been, according to the federal government’s own data.